Is Digitalization the Revolutionary Solution to Payment Issues in Construction Projects?

Late payments are a significant challenge in the construction industry. According to the National Association of Credit Management, nearly 70% of companies report delays in getting paid. These delays can disrupt project timelines and budgets, causing financial strain, slowing progress, and even harming professional relationships. Interestingly in construction projects, late payments aren’t always due to a lack of funds but can often result from operational inefficiencies, like tracking budgets and approvals.

Embracing Digital Payment Solutions

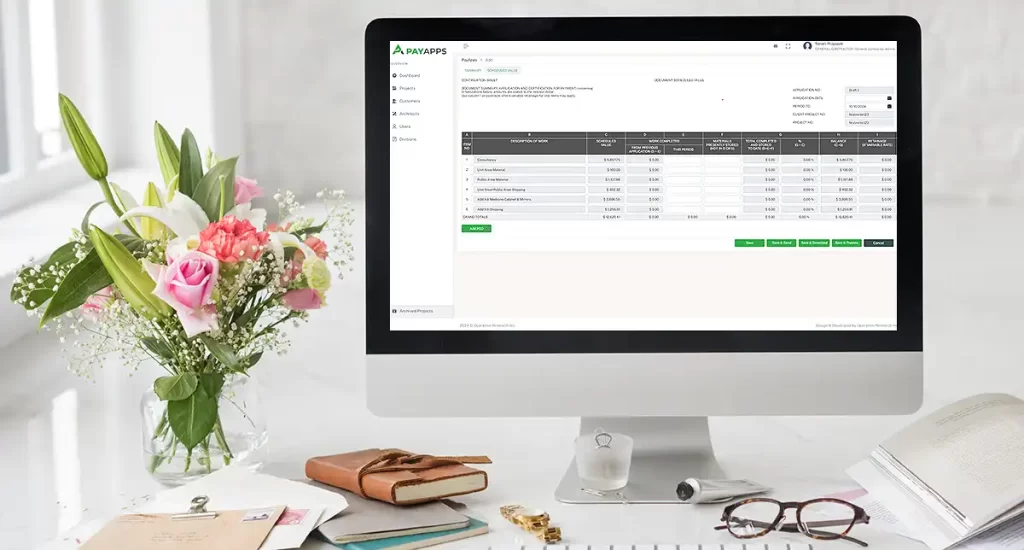

Systematic tracking of milestones and budgets is essential for smooth project execution, and digital payment applications can make a huge difference. Automating payments helps streamline the payment process, making it quicker and more efficient. By using a digital construction pay application like PayApps, contractors can simplify payments, ensuring that all parties are paid on time.

What is a Construction Payment Application?

A construction payment application is a document that contractors submit to request payment for work completed during a specific period. These applications typically include details on work performed, materials used, and outstanding balances. Construction payment applications are vital for maintaining cash flow in construction projects. However, manual applications are often slow, error-prone, and difficult to track, causing payment delays.

a. Managing payments in construction projects

With a digital pay application, this process is automated, transforming a time-consuming task into an efficient, streamlined system. This approach enables faster approvals, enhanced construction documentation, and quicker payment turnarounds.

Standardized Contract Documents with Pay Application

Standardized contract documents, like those provided by PayApps, ensure consistency in creating and processing payment applications. Digital forms simplify the approval process, reducing confusion and miscommunication among contractors, project managers, and owners. Unlike traditional forms that are prone to human error, PayApps ensures the accuracy of every contract detail.

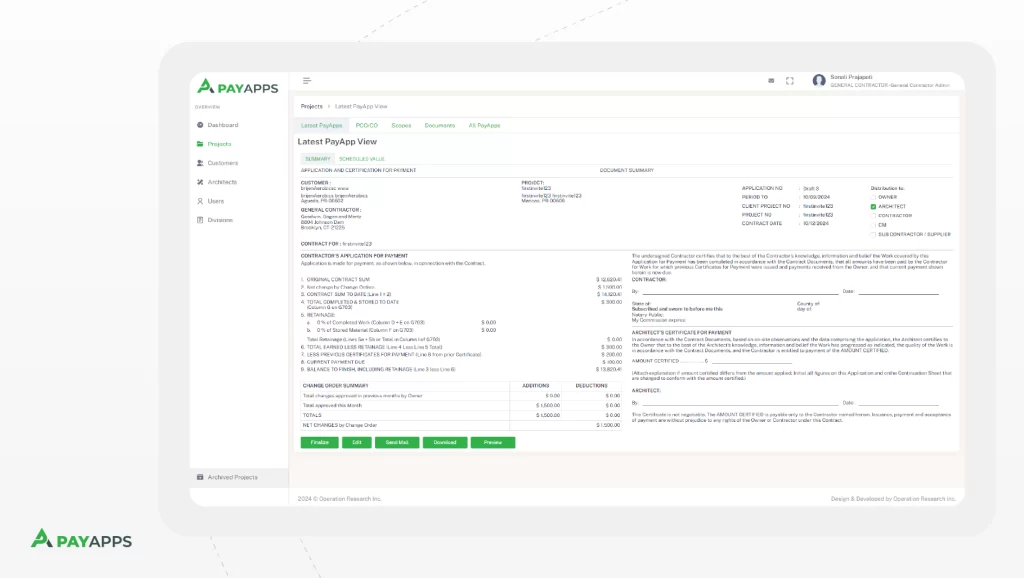

The Pay Application and Certificate for Payment

PayApps includes a Certificate for Payment feature, which allows contractors to submit payment applications digitally. This certificate facilitates transparency and keeps all involved parties informed, reducing delays from missing information or errors in the construction project.

The digital format is easy to use, significantly reducing the need for manual paperwork and freeing contractors from administrative burdens so they can focus more on the project.

Pay Application Structure

1. Project Information: Part I of the pay application collects key project details, including the project name, location, and owner or developer information. This helps align all parties and ensures that payment requests are associated with the correct project and scope of work.

2. Contractor’s Application for Payment: This section captures details about work completed, the percentage of work done to date, the value of completed work, and any remaining balances. PayApps presents this information in a clear, user-friendly format, reducing the likelihood of disputes and payment delays.

3. Sign & Certify: The final part of the pay application requires digital signatures and certification from the contractor and architect or project manager. This certification verifies the accuracy of the work listed, increases accountability, and accelerates the payment approval process.

b. Streamline construction documentation and pay applications

Introducing PayApps.ai

PayApps is an intuitive, cost-effective platform designed for the construction industry to streamline financial management. It enables contractors to create pay applications—essentially payment requests for completed work—quickly and accurately.

Why Use PayApps?

PayApps simplifies the payment process for everyone involved—contractors, subcontractors, and project owners. By automating key aspects of the pay application process, it helps ensure approvals, reduces human errors, and keeps financial documentation organized. This lets construction professionals focus on managing projects rather than paperwork.

Core Features of PayApps

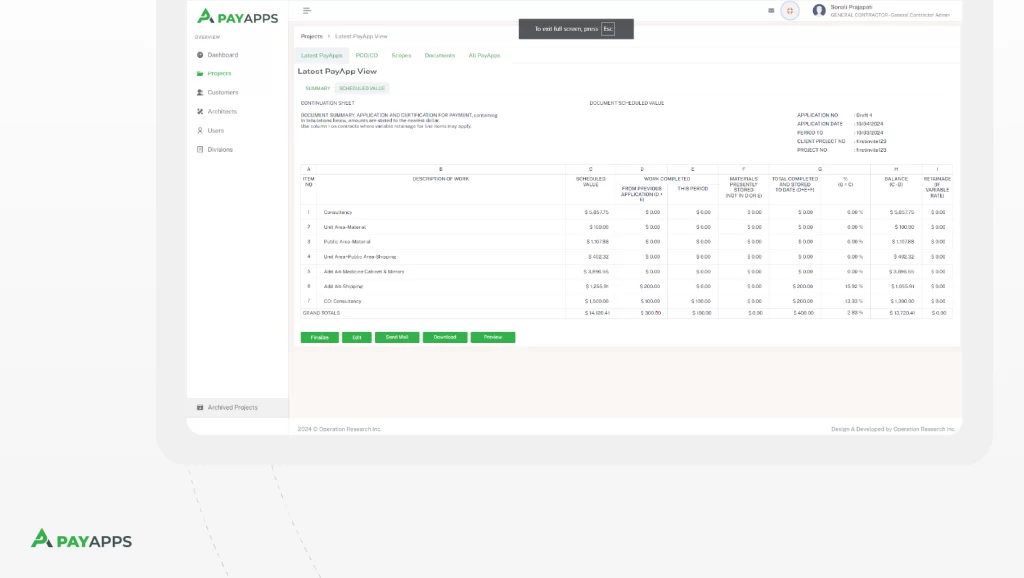

Automated Data Entry: PayApps pulls in information from essential documents like schedules of values and change orders, allowing users to update only the work completed and materials on-site, making the process faster and easier.

Digital Record Keeping: PayApps provides a secure digital archive for all pay applications and related documents, so contractors can keep accurate records without the risk of losing paperwork.

c. Mange change order effectively

Change Order Reconciliation: PayApps cross-checks change orders automatically, ensuring consistency across records and reducing miscommunication between subcontractors and general contractors.

Quick Application Turnaround: PayApps is designed for speed, helping contractors complete pay applications quickly to support timely cash flow, essential for any construction project.

Professional Output: PayApps generates polished, standardized documents that meet industry standards, enhancing credibility and professionalism.

User-Friendly Interface: Even for users less familiar with digital tools, PayApps is easy to navigate, making the process more accessible and efficient.

Affordability: PayApps offers competitive pricing, providing excellent value for construction professionals of all sizes without sacrificing functionality or quality.

d. PayApps Latest View

Who is PayApps For?

PayApps is designed for a wide range of professionals in the construction industry, including:

– Owners & Developers: Enables efficient tracking of financial applications for smooth construction project management.

– General Contractors: Provides a system for handling payments efficiently across multiple subcontractors.

– Specialty Trades: Allows subcontractors to submit precise, timely payment requests to ensure prompt compensation.

– Architects & Engineers: Ensures accurate billing and documentation for smoother project execution.

In short, PayApps benefits anyone managing payments or construction documentation in the industry.

How Much Does PayApps Cost?

Unlike traditional methods, which come with hidden time costs, errors, and delays, PayApps uses a transparent pricing model. The cost depends on the number of users and transactions required for the project, with options tailored to meet diverse project needs.

Alternatives to PayApps

While PayApps is highly efficient, some companies may still rely on manual methods or other digital platforms. However, these alternatives often lack the seamless integration, automation, and ease of use that PayApps provides, making it a standout solution for construction payment applications.

Final Thoughts

PayApps streamlines financial management for construction companies, ensuring timely payments and simplified payment requests, freeing up contractors to focus on delivering quality work. As the construction industry continues to embrace digital solutions, tools like PayApps are essential for achieving faster transactions and more sustainable practices. By prioritizing prompt payments with PayApps, contractors can reduce financial stress and build stronger relationships with their partners. The future of construction finance is digital—are you ready to embrace it?